The three inside down triple candlestick pattern takes place following an uptrend and is an indication that a reversal is likely to take place next. Reliable Triple Candlestick Pattern 1.

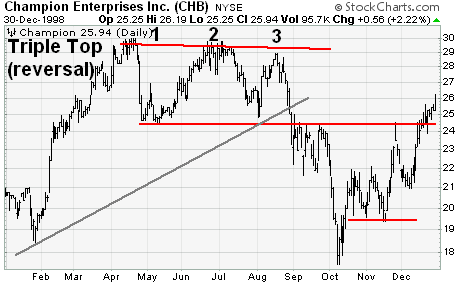

Triple Top Reversal Chartschool

As opposed to the triple bottom it appears at the end of an uptrend suggesting a likelihood of trend change.

. The Tweezer Top pattern is a bearish reversal candlestick pattern that is formed at the end of an uptrend. The pattern is formed when three bullish candles follow a down trend reversal at a support. On the other hand the evening star is created after an uptrend not in a sideways range.

Both the Morning Star and Evening Star patterns comprise a combination of three candlesticks but they signal opposite directional movement in a currency pair. Context Generally this pattern is found within low trading ranges preceding downtrends and the break of resistance which confirms this pattern is what makes it a reversal pattern. It is straightforward and it is defined by three clear peaks that form about the same level in the market.

Its a chart on Tesla starting around the 19th October. The double top pattern is a chart pattern that occurs when the price moves in a similar pattern to the letter M. Inverted Head and Shoulders.

HEAD SHOULDERS gives traders a confirmation that a bearish reversal is about to take place. It is very dependable in stock chart patterns used in technical analysis. Buyers are in control as the price makes a higher high followed by a pullback.

Both the tweezer candlestick make almost or the same high. First the triple top pattern takes place in a sideways range. Sesuai dengan tema maka pada pembahasan kita kali ini kita akan bahas dan menjelaskan pola triple top dalam trading forex.

It consists of two candlesticks the first one being bullish and the second one being bearish candlestick. Para trader pasti sudah sangat mengetahui bahwa jenis pola candlestick yang banyak dipakai oleh para trader karena akurasinya lebih tinggi yaitu pola candlestick triple. The most popular triple candlestick reversal patterns include the following pairs.

Morning Star and Evening Star Morning Doji Star and Evening Doji Star Three White Soldiers and Three Black Crows Three Inside Up and Three Inside Down Three Outside Up and Three Outside Down Morning Star The morning star pattern occurs after a downward price move. The Triple Top Reversal is a bearish reversal pattern typically found on bar charts line charts and candlestick charts. Each bar posts a lower low and closes near the intrabar low.

The fourth bar opens even lower but. The triple top chart pattern forms after a sustained rally. They are of four main types.

A triple top or triple peak is a bearish chart pattern. Secondly the triple top requires a minimum of five to six candles to create. As with a triple top it is generally assumed that the longer a particular trend takes to fully develop the stronger the change in price once a breakdown occurs.

Unlike the bullish tweezer bottom the tweezer top formations first candlestick shows a potential bullish trend that tops out without a wick. The triple bullish candlestick patterns are formed by three candlesticks. The third candle is large and green.

The middle candle is short and lies below the first not including the wicks. Morning Star and Evening Star. When the Tweezer Top candlestick pattern is formed the prior trend is an.

The top of the third candle is within the upper half of the first candle. The second candle should close near its high leaving a very small upper wick which denotes a bull strength. Here is an example of a three white soldiers.

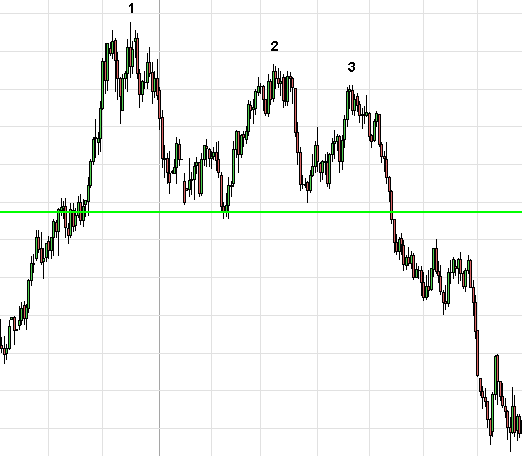

The triple top is a bearish chart pattern that tests the high of a price three times before the price falls and breaks to new lows. There are three equal highs followed by a break below support. This pattern is a specific form of.

Double top analysis is used in technical analysis to explain how prices move in a security or other investment and can be used as part of a trading strategy to exploit recurring patterns. The Evening Star pattern is a three-candle bearish reversal candlestick formation that appears at the top of an uptrend. The tweezer top candlestick is a bearish pattern made of two candlesticks in a chart.

It signals the slowing down of upward momentum before a bearish move lays the foundation for a new downtrend. A triple top chart pattern can happen on any time frame but is only considered valid if it happens after an uptrend. You can see that because we hit the bottom 3 times at roughly the same price.

You should notice a long bullish candlestick at the start of the pattern. Triple Bullish Candlestick Patterns. If its a more marubozu candle its even better.

Note that a Triple Top Reversal on a bar or line chart is completely different from Triple Top Breakout on a PF chart. What Candlestick Pattern is show below. These three peaks can be connected by a horizontal trend line and be considered resistance.

This means that price is trading sideways as each of the three tops is formed. B Bullish abandoned baby. Generally they are bullish reversal patterns.

When you see a Morning Star pattern you should consider it to be a bullish signal. Three candlesticks form a morning star candlestick pattern if. A Triple Top is a bearish reversal chart pattern that signals the sellers are in control the opposite is called a Triple Bottom.

As major reversal patterns these patterns usually form over a 3 to 6 month period. A triple top is created when price action forms three peaks very close to the same price area. Heres how it looks like Let me explain 1.

The bullish three line strike reversal pattern carves out three black candles within a downtrend. Similar to the double bottom and double top these triple stick candlestick patterns consist of more than three candles but theres three major areas you should look out for. Memahami Pola Triple Top Dalam Trading Forex.

The first candle is large and red.

Triple Top Pattern Explained Stock Chart Patterns

:max_bytes(150000):strip_icc()/dotdash_INV-final-Technical-Analysis-Triple-Tops-and-Bottoms-Apr-2021-01-4e2b46a5ae584c4d952333d64508e2fa.jpg)

Technical Analysis Triple Tops And Bottoms

Trading The Double Top And Triple Top Reversal Chart Patterns

What Are Triple Top And Bottom Patterns In Crypto Trading Bybit Learn

:max_bytes(150000):strip_icc()/dotdash_Final_Triple_Top_Dec_2020-02-f2c3428399574d4181d943daf126cf77.jpg)

/dotdash_Final_Triple_Top_Dec_2020-01-78a37beca8574d169c2cccd1fc18279d.jpg)

0 komentar

Posting Komentar